Nov 18, 2025

5min read

Authors

Preet Khalsa

Tom Mendoza

Kaushik Subramanian

Each Monday, Leena refreshes her banking portal and watches cash crawl across borders. Her Singapore-based parts distributor sells to factories in Vietnam, Mexico, and Poland, and sources components from suppliers in Germany. Payments move through banks that require cash to be pre-funded abroad, locking up working capital and adding multi-day delays.

By Wednesday, suppliers in Ho Chi Minh City and Monterrey hold shipments; clock ticks. Thursday, a German vendor halts new orders until invoices clear. Friday, cash that could fund marketing or payroll sits as “float,” while the CFO juggles credit lines. Margins thin from FX spreads and bank fees; reconciliation delays mean weekend overtime.

Leena’s team is trapped on financial rails retrofitted to cross-border transactions. Each delay compounds: empty shelves, frayed trust, lost orders, slower growth.

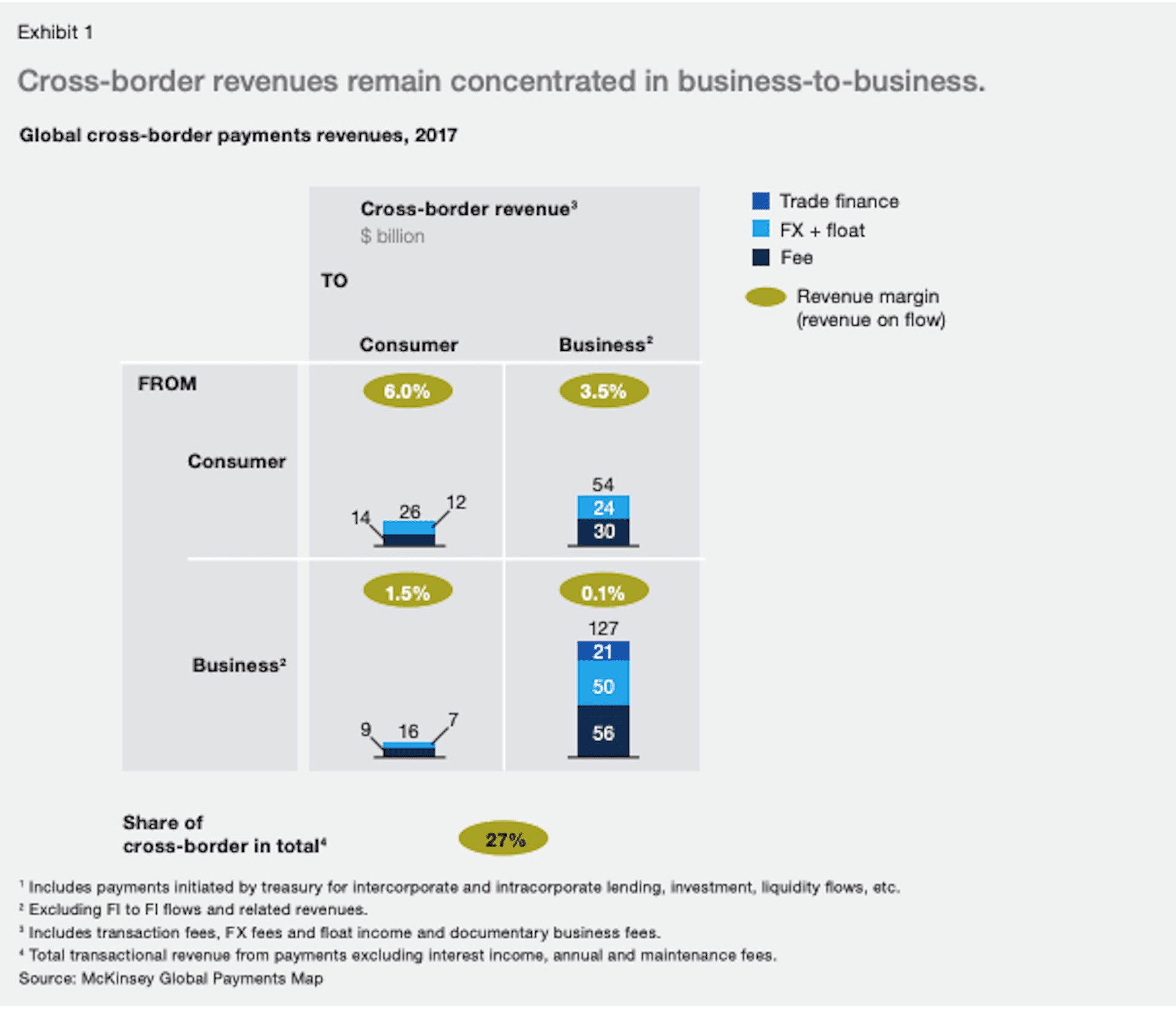

FX payments was a $190B revenue pool in 2023, expected to grow to $280B by 2030. Within FX, B2B is the highest revenue lowest margin category.

Source- McKinsey

With tailwinds around globalisation and an emerging long tail of businesses, global growth expected in mid-term in all geos, highest in APAC and LatAm.

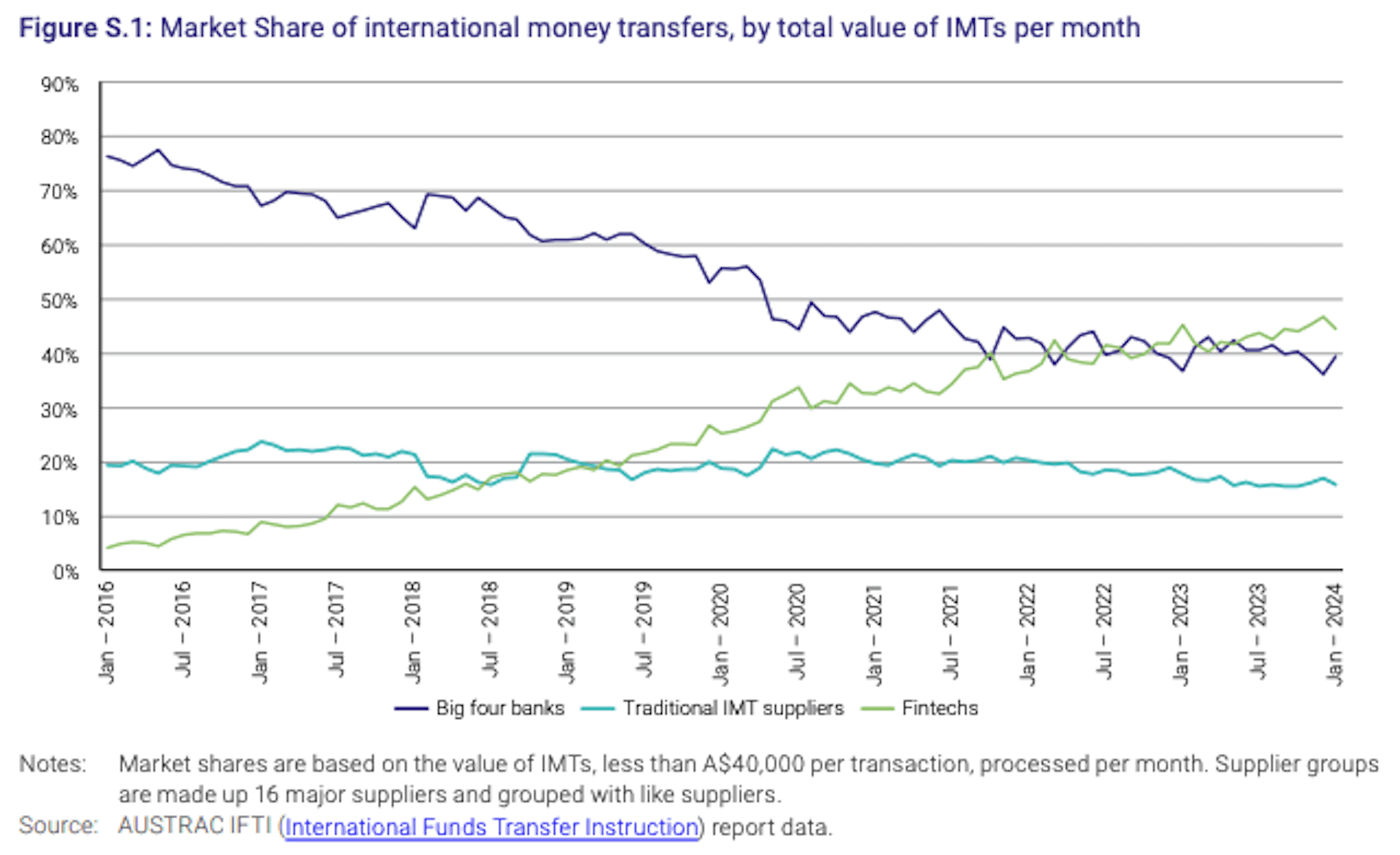

Banks power 92% of B2B cross-border payments. However, they are being challenged specially in the B2C category. An Australian study on sub $25k transfers shows that fintechs are eating into banking market share in low value transactions.

While most banks don’t report their FX income separately, Standard Chartered made $1+B in cross-border transaction services income in EVERY QUARTER since Q1 2023.

Customer preferences in cross-border payments

Consumers prefer speed, convenience (UI) and better rates.

Businesses prefer,

Compliance incl insulation to “crypto”, AML

Cost

Low on transaction: won’t move slowly solely to save some bps

High returns on float

Cheap credit lines to minimise working capital

Speed, if it makes sense for business

Tech integration

Coverage in multiple markets

Vendor valuation should be much higher than treasury exposure to disincentivise unethical activities

Enter, Stablecoins

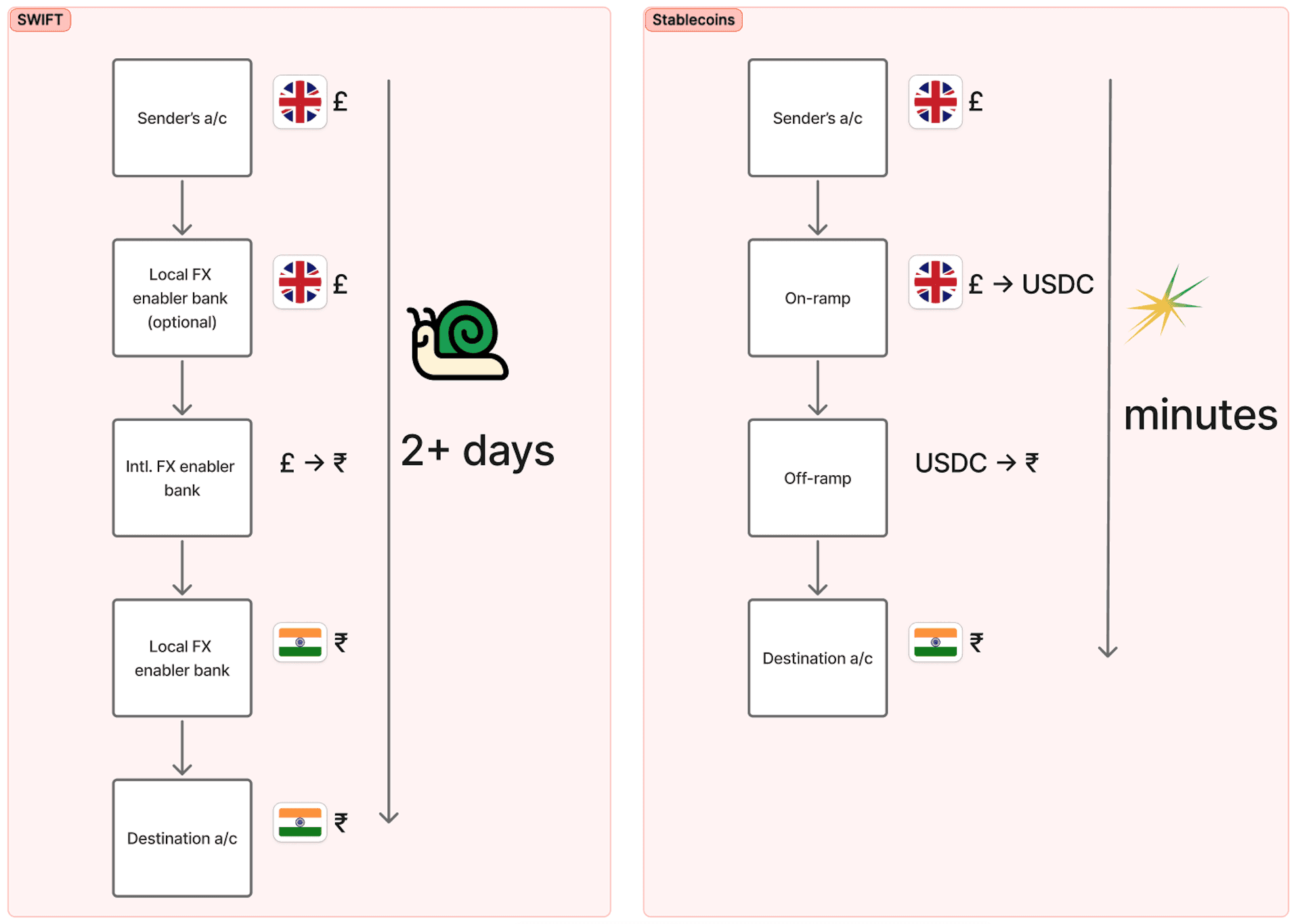

Stablecoins solve for speed and cost of settlement.

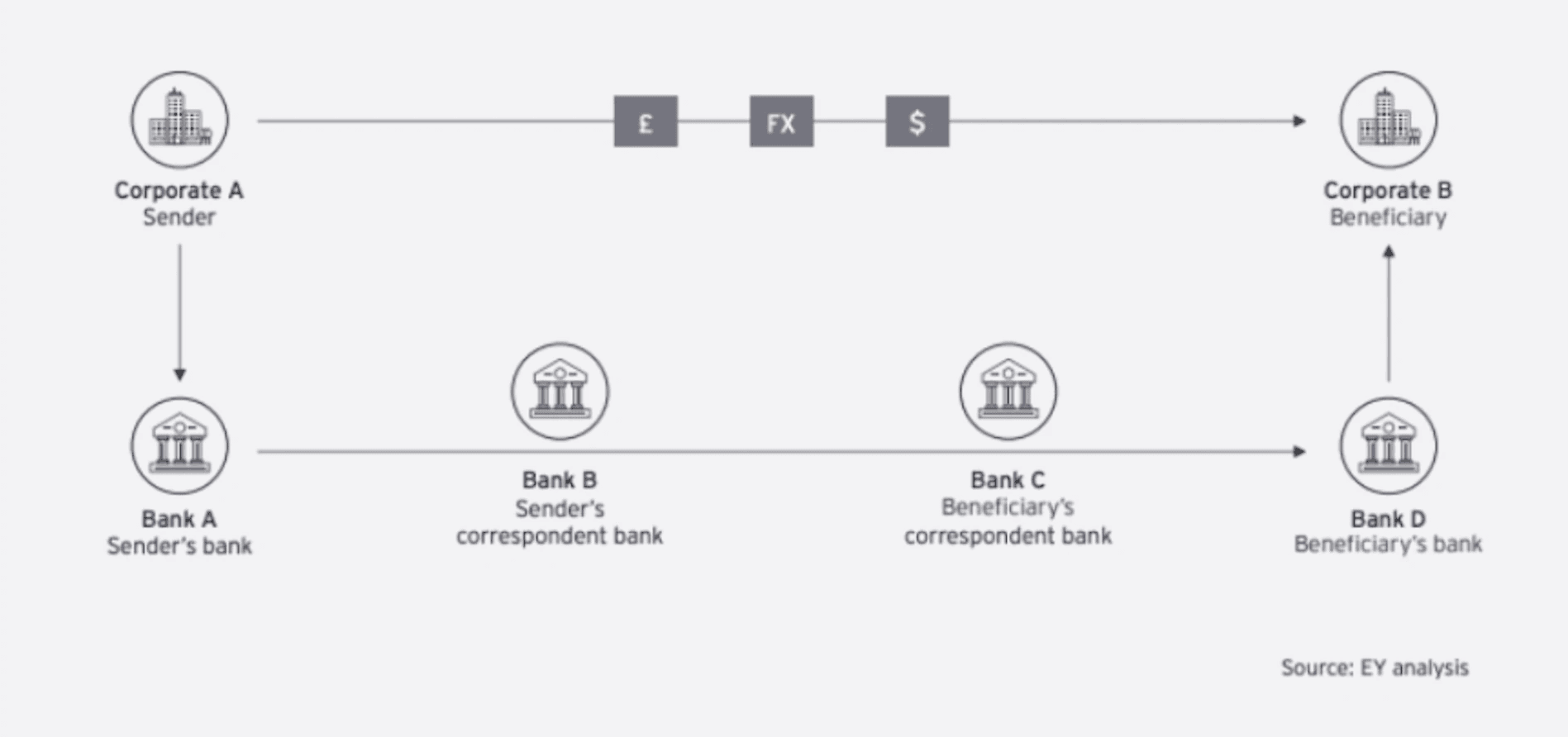

Traditional method: payments move through correspondent banks over SWIFT, with daily cut-offs and multiple intermediaries. Money must be pre-funded in foreign accounts (nostro/vostro), adding fees, delays, and tying up cash.

Nostro = your bank’s money held at another bank abroad (“ours with you”).

Vostro = another bank’s money recorded at your bank (“yours with us”).

Stablecoins: value moves on blockchains, settling in minutes, 24/7, with clear finality and fewer middlemen. FX happens at the edges: local to stablecoin to local, so spreads don’t leak across hops. Businesses can use API wallets for just-in-time liquidity, net flows between partners, and automate treasury, cutting float and reconciliation work. Regulated issuers and licensed on/off-ramps (e.g., MiCA) bring KYC/AML and auditability, easing compliance concerns.

Result: faster payouts, lower unit costs, and more reliable operations—especially for growing APAC/LatAm corridors and sub-$25k transfers.

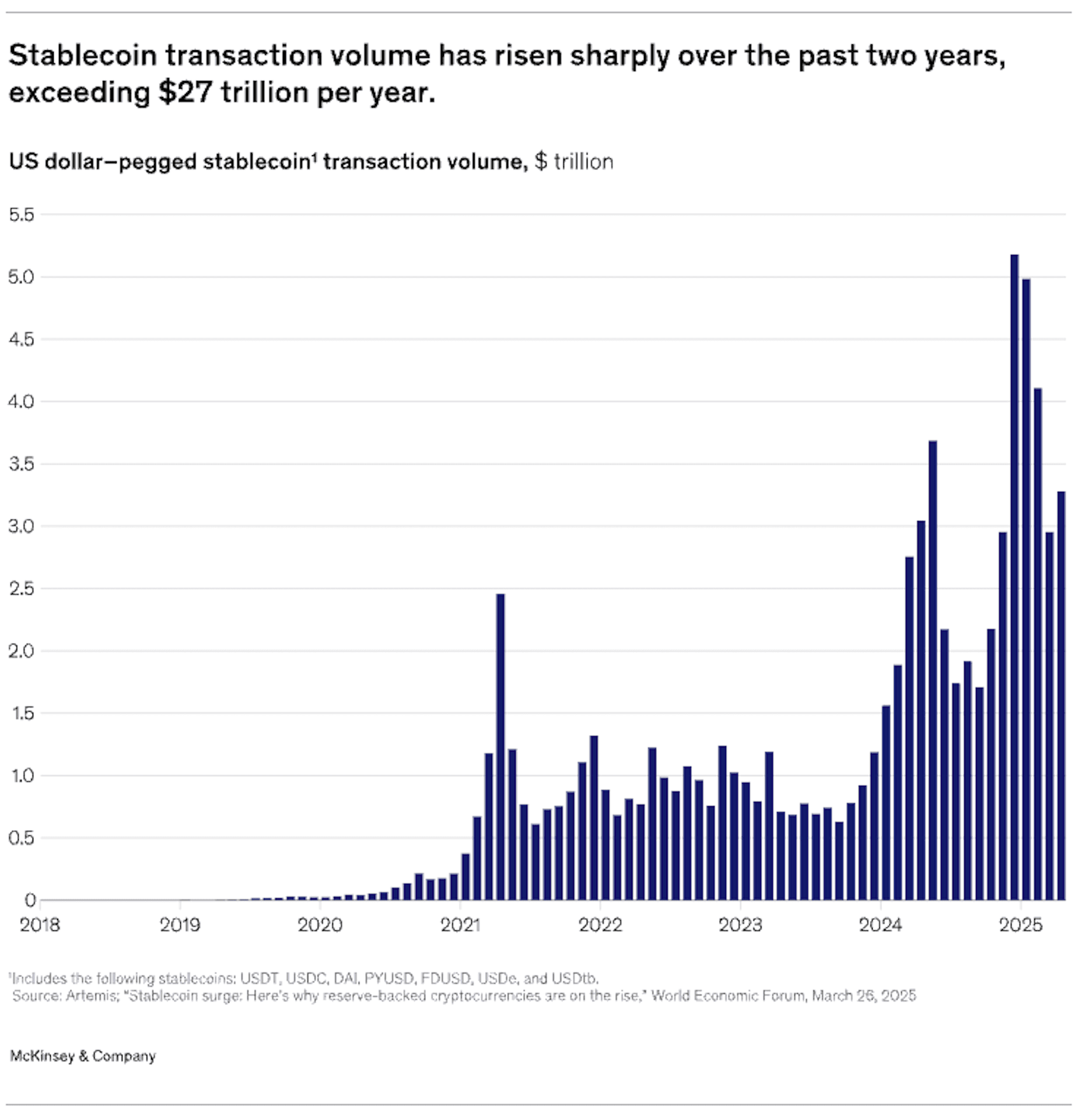

There has been a surge in new products enabling cross-border transactions leveraging stablecoins which has reflected in volumes inflecting.

Source- McKinsey

Following are some scaled tech businesses that are either already growing on the back of stablecoins momentum in FX transactions, or well positioned to further increase margins by leveraging the technology–

Company | Founded | HQ | Scale |

Airwallex | 2015 | Singapore | $700M revenues, raised $1B+ at $6B EV |

Bridge | 2022 | SF | Acquired by Stripe for $1B |

BVNK | 2021 | UK | Raised $90M at $750M EV. Have Deel and dLocal as customers. |

Banking Circle | 2013 | UK | $80M EBIDTA reported in news |

Nium | 2016 | Singapore | Raised $600M, $82M rev in 2022 |

Paxos | 2012 | NY | Raised $550M at $2.5B EV, used by Nubank |

MiCA and Genius Act – Web 2 and 3 Clubs need to rethink moats!

With the regulation of Stablecoins, licensed entities like banks are no longer constrained to act on old suboptimal fiat rails.

FX-Stablecoins fintech opportunities

[1] Acquiring customers – Businesses and consumers

This category needs to move fast since banks and neobanks are likely to be fast-followers on Stablecoin products. Though it took decades of legacy banking for companies like Revolut, Nubank and Monzo to get started, so if you have a strong insight on acquiring and retaining customers we are excited to chat with you! We see early traction in companies leveraging stablecoins powered/ enabled treasury as a wedge into B2B neobanks.

Companies building in this category include Aspora, DolarApp, Bluerails and Caliza

[2] Shovels – Enabling acquirers of customers

As incumbents ramp up to the new rails, there’s a window of opportunity for infrastructure players to lock in application layers and solve hard problems on FX tooling. We think it is a combination of,

Deep technical and workflow integrations, including B2B2B/ B2B2C fintech applications

Licenses in both onramp and offramp countries

Payment systems being integrated or better, powered by FX infrastructure provider

Manage treasury of application products to become liquidity pools, compounding in integration moats and network effects

Minimising float requirements

While the market looks crowded from afar, players solving the hard parts (tech, compliance, licenses) to achieve some or all of those above points are relatively few.

Some companies building in this category include OpenPayd, MuralPay, Link, MentoLabs, Orbital, OpenFX, Sphere, Rail.io and Noah.

Call for startups!

We understand that the space is evolving quickly. We are hungry to learn and help build Generation Defining Companies in this category.

If you have gotten this far, we should definitely chat!